International Taxation and Public Finance

STUDY PROGRAMME

International Taxation and Public Finance

Degree Conferred

Master of Science (M.Sc.)

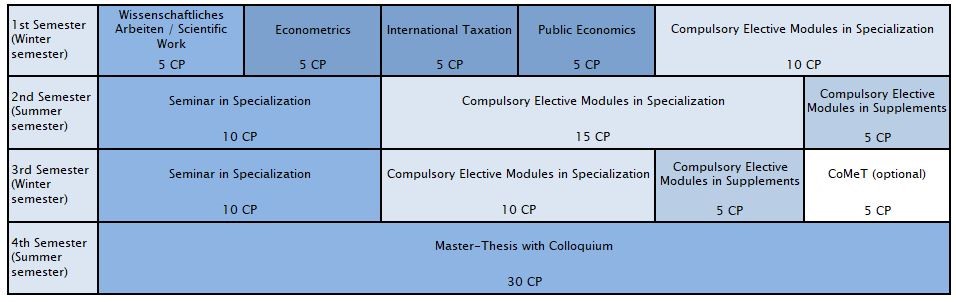

Duration

4 Semesters

Enrollment

Wintersemester

Admission restriction

No restricted admission

Entry requirements

1. Relevant bachelor’s, diploma, or comparable degree with at least 140 ECTS (at the time of applying), and an average grade of 2,9 or better, determined from the examination results.

- A study program is relevant if at least 60 ECTS (EU degrees) or 12 modules (non-EU) in economic courses, and at least 15 ECTS (EU degrees) or 4 modules (non-EU) in courses in the field of quantitative methods have been acquired.

2. Proof of relevance with the faculty’s verification form.

- [Note: Applicants who have obtained their bachelor's degree at the Faculty of Economics and Management of Otto-von-Guericke-University Magdeburg do not have to prove the relevance of a completed undergraduate degree, as this information is already known to the faculty.]

3. Proof of language skills:

- Proof of English skills at B2-level and

- Proof of German skills at B1-level

- The required language skills proof with one of the following options.

Applicants, who apply for a higher semester find the additional necessary applications here.

Application deadline

Applicants with German Bachelor degree

an der OVGU

15 September

Applicants with international Bachelor degree

über uni-assist

15 July

Language

German/English

Objectives

The research and practice-oriented, quantitative Master's degree course in “International Taxation and Public Finance” provides students with knowledge of national and international tax law, corporate taxation and in finance, thus combining business and economics topics. Students are introduced to scientific economic methods and the evaluation and analysis of data (econometrics). The focus is on acquiring advanced knowledge in order to deal with and analyse tax and fiscal issues and problems in companies as well as private and government organizations. The course combines well-founded and practical knowledge in the field of tax law and tax theory with advanced scientific methods in the field of microeconomics and data analysis. Teaching takes place in English and German and can also be studied entirely in English with limited elective options.

Career Perspectives

The "International Taxation and Public Finance" degree program qualifies graduates for high-level and managerial positions in the following areas

- Consulting (tax consulting, auditing, management consulting, political consulting, financial consulting, support for transformations and acquisitions, legal advice, insolvency consulting),

- Corporate management (tax department, internal and external accounting, finance department, corporate controlling),

- Administration (financial administration, BAFIN, ministries of finance and economics, chambers of tax consultants, regulatory authorities), associations (tax consultant associations, industry associations, etc.) and

- Science (research institutes, universities).

Competencies and Interests Required

- Prospective students should have an interest in quantitative analysis methods as well as legal and economic contexts.

- Basic knowledge of accounting, taxes and finance as well as good to very good knowledge of mathematics and statistics are also important.

- Fluency in written and spoken English (language level B2) and a solid knowledge of German (language level B1) are required.